- Weekdays 9:30 AM - 4:00 PM EST

- Fort Lauderdale, USA

Penny Stocks to Buy In 2023

admin

Penny Stocks to Buy In 2023

Investing has got various risks that need to be mitigated so that the returns are better in the long run. There are two kinds of risks that investors need to deal with, such as systematic and unsystematic risks. Penny stocks are cheap and highly speculative stocks that tend to experience more volatility and are prone to unsystematic risk. Hence, mitigating such business or financial risk becomes crucial when looking for penny stocks to buy to gain outsized returns. Let’s explore some of the penny stocks to buy, considering the factors governing them.

June 15, 2023

Lumen Technologies, Inc. (LUMN)

The telecommunications company is listed on the New York Stock Exchange (NYSE). It has been in the news lately due to its partnership with Google and Microsoft for the new ExaSwitch interconnection network system, which will enable to route the internet traffic in an efficient manner without having to connect with a third party due to fiber optics that will exhibit higher performance across the data traffic exchanges. Moreover, the company will also likely benefit if the inflation cools down and there is a pause in the interest rate hike by the Fed as the company has higher debts.

Fundamental and Technical Aspects of the Stock

- The company’s cash flow stands at $1.15 billion per the most recent quarter (mrq), and its current ratio of 1.12 states its ability to meet short-term obligations.

- As derived from Yahoo, the valuation ratios, such as the price/sales ratio of 0.11 on a trailing twelve months (ttm) basis, state it is valued at 11% of the sales. The price/book ratio, per the most recent quarter (mrq) of 0.17, states its book value to be less than the market price. The book value (mrq) per share stands at 10.94.

- The stock touched a low of $1.74 recently and has been currently trading above $2.

- Its 50 DMA stands at 2.23, with a daily relative strength index (RSI) of the stock above 50.

The stock price has upside potential, provided the company’s business prospects improve going forward.

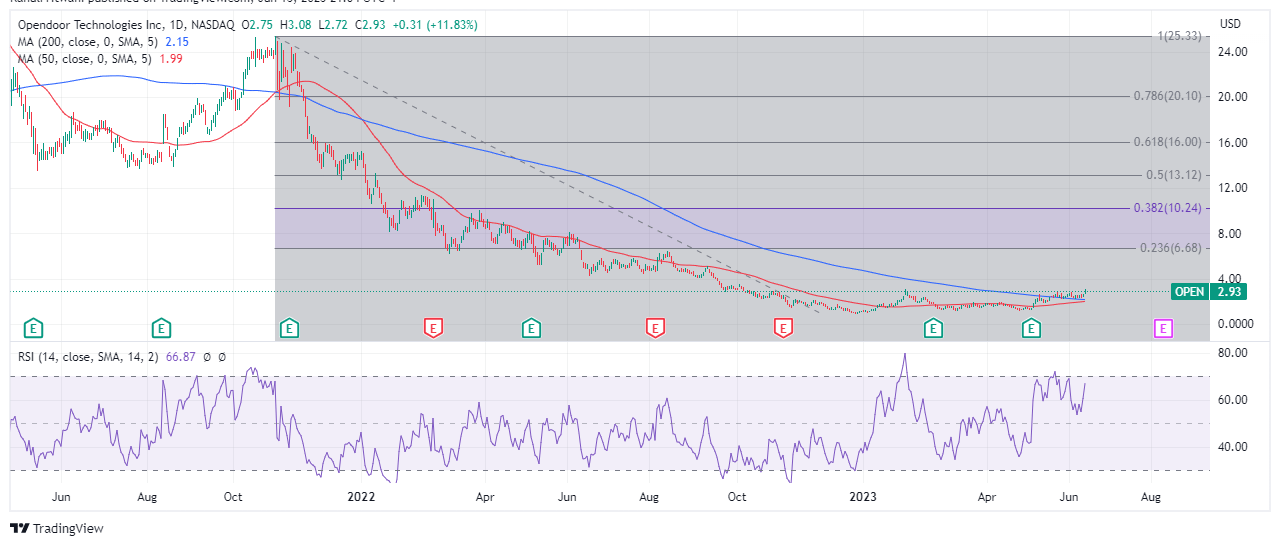

Opendoor Technologies, Inc. (OPEN)

The Nasdaq-listed company was founded in 2014. It is involved in purchasing properties and listing them for resale after making repairs, popularly known as home flipping. The company has reported losses in recent quarters as it depends on the mortgage rates, which have increased to over 5% in the last 15 months due to the Fed’s hiking rates to control inflation.

The CPI inflation data for all items for May 2023 rose 0.1% from April, and the prices for all items YoY increased 4%, which reveals the slowest inflation growth rate from March 2021. Thus, the pause in the interest rates by Fed can help the home flipper company as interest rates stabilize, pushing the demand for the housing market.

Fundamental and Technical Aspects of the Stock

- The company’s book value stands at $1.60 (mrq), and the price/book (mrq) of 1.83 indicates the market price to be marginally ahead of its book value.

- The cash (mrq) on the balance sheet stands at $1.25 billion, and a current ratio of 11.22 can be attributed to the holding up of high real estate inventory.

- The stock is currently trading just below $3, much above its 50-DMA and 200-DMA, which stand at $1.99 and $2.15, respectively.

The stock can grow if the interest rates are paused and the company capitalizes on the housing demand thereon.

FAQs

Systematic risks, such as interest rate and inflation risks, and unsystematic risks, such as business and financial risks, should be taken into account.

The decision for penny stocks to buy should be made based on the underlying financial strength and the company’s future prospects.

You should invest the amount you are comfortable losing as they carry high risk.

You can make penny stocks traded on recognized stock exchanges through a registered broker. However, OTC penny stocks can only be purchased from brokers offering such facilities.

Yes, penny stocks are highly volatile due to less liquidity and high speculation.