- Weekdays 9:30 AM - 4:00 PM EST

- Fort Lauderdale, USA

Hot Penny Stocks Today

admin

Hot Penny Stocks Today

If your portfolio allows you to take an extra risk, you can look for hot penny stocks today that can give you great returns. However, certain key parameters must be evaluated before investing in cheap stocks that usually trade below $5 to ensure the investment is worthwhile.

June 05, 2023

Key Parameters for Evaluating Penny Stocks

Some of the stocks that have become large or mega-cap today were once penny stocks that defied all odds, such as Amazon.com, Inc. (AMZN), Tesla, Inc. (TSLA), and Advanced Micro Devices, Inc. (AMD). All these stocks are part of the Nasdaq 100 index today. However, the following parameters must be considered before investing.

- Strong Financial Performance: Consistent revenue growth, profitability, and positive cash flow attract investors.

- Market Opportunity: Unique products or services, favorable trends, and disruptive technologies in large and growing markets offer expansion potential.

- Effective Management Team: Competent leaders making strategic decisions drive growth and investor confidence.

- Access to Capital: Successful fundraising, partnerships, and market access fuel growth and expansion.

Regulatory and Legal Compliance: Adhering to regulations ensures investor trust and long-term growth.

What are the Hot Penny Stocks Today?

Investors pour money into penny stocks, expecting to gain outsized returns, but most of them fail. Smart money invests in such stocks that are poised to grow and have a reasonable valuation. Smart money refers to the capital of institutional investors, central banks, large funds, etc.

It is not wise to simply chase smart money. Instead, you should also do your due diligence before investing in pink sheet stocks with low liquidity and high speculation.

So, let’s look at some of the hot penny stocks today that seem promising.

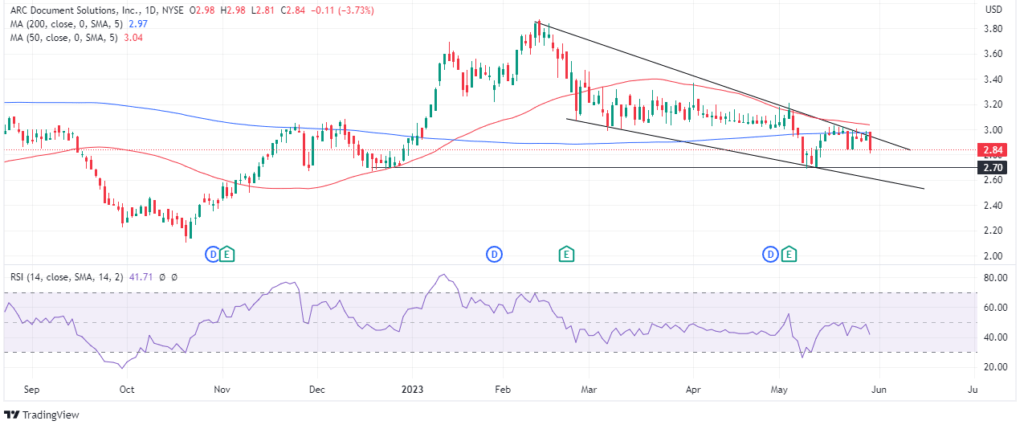

Arc Document Solutions (ARC)

The company’s domestic sales have shown growth for seven consecutive quarters, and its profit margin stands at 3.88%, with total cash standing at $49.8 million, as reported in the most recent quarter (mrq). The 50-day moving average, i.e., 50-DMA, stands at $3.04, whereas the 200-day moving average (200-DMA) is at $2.97. As per CNN, institutional investors such as Renaissance Technologies LLC and The Vanguard Guard, Inc. own 6.68% and 4.49% stakes in the company. However, it is important to consider proper risk management while investing due to the high volatility in such cheap stocks.

Vaalco Energy, Inc. (EGY)

The Houston-based NYSE-listed company is involved in acquiring and developing properties for producing natural gas, crude oil, and natural liquids. As stated in Yahoo, the trailing P/E ratio stands at 5.26, with the forward dividend yield at 6.35%. The company’s net income for fiscal year 2022 was $51.9 million ($0.73 diluted EPS), and total cash in the most recent quarter was $52.12 million.

As reported on CNN, institutional investors such as BlackRock Fund Advisors and The Vanguard Group, Inc. hold 5.98% and 5.12% stakes, respectively. The 50-DMA for the stock stands at $4.20, and 200-DMA at $4.67. Moreover, the stock’s performance and growth are heavily related to the oil and gas industry.

FAQs

Thorough research, analyzing positive news or catalysts, and assessing financial health, management team, and market potential are crucial for identifying such stocks.

When investing in pink sheet stocks, set realistic expectations, diversify, and use risk management strategies like stop-loss orders and limited investments.

They have the potential for high returns, but there are no guarantees. Thorough research and risk management are crucial for increasing the chances of positive outcomes.

Catalysts include positive news like FDA approvals, contract wins, partnerships, or strong earnings.

Hot penny stocks may trade on major exchanges, but many are on OTC or smaller exchanges, posing a higher risk.