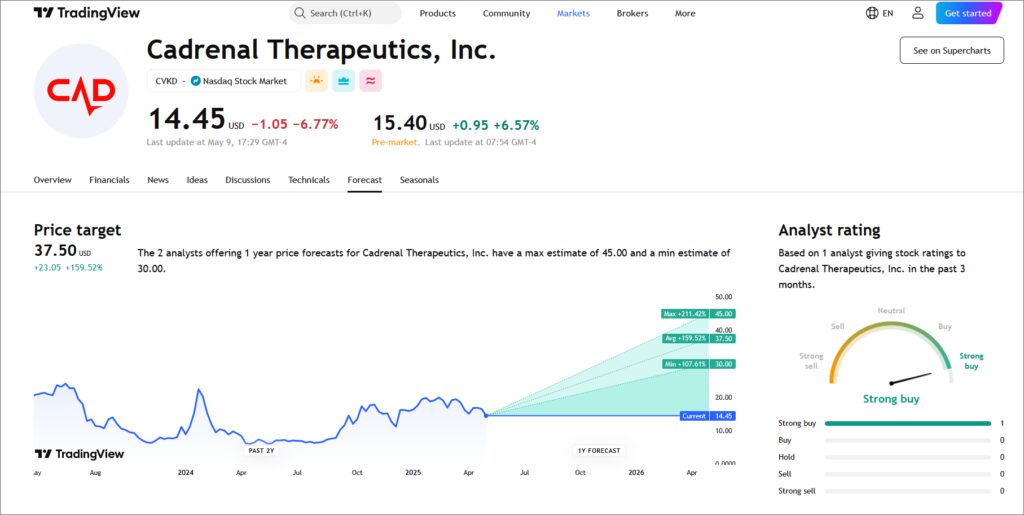

✅ Current Analyst Price Targets for CVKD

✅ Low Target: $30 (+100%)

✅ Average Target: $36 (+140%)

✅ High Target: $45 (+200%)

✅ FDA Fast Track + Orphan Drug Status Regulatory tailwinds could speed approvals and extend market exclusivity.

✅ Phase III Trial on the Horizon Pivotal data could be a game-changer for Tecarfarin in a $45B+ market.

✅ Abbott Collaboration Potential Talks with a major industry player could validate Tecarfarin’s market fit.

✅ Tiny Float + Strong Cash Reserves With only 1.5M share float and $11M+ in cash, CVKD is built for sharp moves.

✅ Insiders Hold 26% of Shares Leadership is fully aligned with investors.

🧬 Cadrenal Therapeutics (NASDAQ: CVKD)

🚀 A New Goliath Targeting the Multi-Billion Dollar Anticoagulation Market

📈 Why CVKD Deserves Your Attention

Hope your screens are green and your watchlists are ready—because we’ve uncovered a biotech gem flying under the radar and poised for a potential breakout.

💊 What They Do

Cadrenal Therapeutics is a late-stage biopharma company developing:

🔬 Tecarfarin – a novel vitamin K antagonist designed to offer:

✅ Safer, superior chronic anticoagulation

✅ For patients with cardiovascular conditions

🧠 How Tecarfarin Stands Apart

🧪 Metabolism Mechanism:

Unlike warfarin, Tecarfarin is metabolized by human carboxylesterase-2, not CYP450 enzymes.

✅ Key Advantages:

🔁 Reduces drug-drug interactions

🧬 Minimizes genetic variability from CYP2C9 polymorphisms

🧩 Offers more stable anticoagulation

💥 Market Opportunity

💣 Warfarin has dominated the space with little competition—until now.

❤️ Coronary Heart Disease is Rising

📊 The blood thinner market is growing even faster:

💸 2025: $34 Billion

💸 2026: $45 Billion

CVKD is positioning Tecarfarin to challenge Warfarin and potentially capture a major share of this booming market.

🚨 A High-Potential Play for Biotech Traders & Investors

💡 Why CVKD Deserves Your Attention

Cadrenal Therapeutics presents a compelling opportunity for investors and day traders focused on the biotech space. With a promising lead candidate, strategic industry movement, and a healthy balance sheet, CVKD is a ticker to watch extremely closely right now.

🧠 A Deep Dive for Traders & Investors

Cadrenal is quietly gaining traction in the massive anticoagulation (blood thinner) market. Its lead drug, Tecarfarin, is designed to improve safety and effectiveness for patients with implanted cardiac devices or rare cardiovascular disorders.

🔍 Key Highlights:

💰 Market Cap: ~$30 Million

📉 Micro Float: ~1.5 Million Shares

💵 Cash Reserves: $11+ Million

⚙️ Fully Funded to reach near-term clinical milestones

💼 Clinical Pipeline & Strategic Collaborations

Cadrenal Therapeutics (NASDAQ: CVKD) is entering a pivotal moment in its development journey. Here’s why the market is paying close attention:

🧪 Tecarfarin Phase III Trial

CVKD is finalizing its Phase III protocol targeting patients with limited anticoagulation options.

✅ Positive trial data could spark a major re-rating and even buyout interest.

🧬 Dual Orphan Drug Designations

These designations provide:

🟢 Fee reductions

🟢 Market exclusivity (up to 7 years)

🟢 Expedited FDA reviews

➡️ All of which increase Tecarfarin’s commercial appeal in rare cardiovascular conditions.

🤝 Abbott HeartMate 3 Partnership Talks

CVKD is in active discussions with Abbott to co-develop trial protocols for Tecarfarin.

💡 A formal deal could:

🔓 Unlock FDA fast-track status

💥 Establish CVKD as a core anticoagulant provider in a multi-billion-dollar installed base

📈 Rising Institutional Interest

📊 Hedge funds and specialized biotech investors are accumulating shares ahead of expected catalysts.

🔒 Insider Ownership: Over 26% of shares are held by leadership—showing confidence and alignment with investors.

🚀 Key Catalysts on the Horizon

📍 Phase III Trial Kickoff (Q1 2025 Expected)

CVKD has completed its Type D meeting with the FDA, clearing the path to launch its pivotal trial in LVAD patients.

📍 FDA Fast Track Designation

For end-stage renal disease (ESRD) and atrial fibrillation (AFib) — ensures:

✅ Rolling NDA review

✅ Frequent FDA engagement

✅ Accelerated path to approval

📍 U.S. Manufacturing Secured

CVKD has transferred API production from Asia to a U.S.-based CDMO, mitigating supply-chain risks as it scales for trial execution.

💵 Analyst Price Targets

💚 Current Price: $15.00

📈 Low Target: $32 (+113%)

📈 Average Target: $36 (+140%)

📈 High Target: $45 (+200%)

👉 Even the most conservative outlook reflects triple-digit upside.

👨💼 Leadership Team Aligned with Investors

👨✈️ Quang X. Pham — Chairman & CEO

✔️ 20+ years in biotech leadership

✔️ Owns 22.26% of CVKD shares

✔️ Background in regulatory strategy & capital markets

🏗️ Jeffrey Cole — Chief Operating Officer

✔️ Former Amgen executive

✔️ Expertise in bioprocessing, logistics, & scale-up

✔️ Leading manufacturing prep for Phase III

🫀 Dr. James J. Ferguson, MD — Chief Medical Officer

✔️ Cardiologist & clinical trial expert

✔️ 25+ years of trial leadership

✔️ Driving protocol design & FDA interactions

📢 Bottom Line

Cadrenal Therapeutics (NASDAQ: CVKD) is primed for a potential breakout:

💰 $11M+ in cash

🧬 Late-stage drug with dual orphan status

📉 Tiny float of 1.5M shares

🤝 Potential Abbott collaboration

📍 Phase III trial kickoff looming

✅ Insiders own 26%+ of shares

⚡️ A single major update—clinical, regulatory, or strategic—could send this stock soaring. For traders and biotech investors alike, CVKD should be on top of your watchlist.

📘 Disclaimer: This report is for informational and educational purposes only. It is not investment advice. Always perform your own due diligence before making financial decisions.

PennyStocksUnited (operated by PSU Media LLC) is not a registered investment advisor, broker-dealer, or licensed financial professional. The material provided in this communication is for informational and educational purposes only and should not be construed as personalized investment advice, a recommendation, or a solicitation to buy, sell, or hold any securities. All opinions, analyses, and forecasts expressed herein are subject to change without notice, and the information presented may not be complete or accurate. Readers are strongly encouraged to conduct their own research, consult with a licensed financial advisor, before making any investment decisions. We have been compensated five thousand dollars (USD) by RELQO Media LLC to disseminate coverage for Cadrenal Therapeutics (NASDAQ: CVKD) from May 10, 2025 through May 16, 2025. This compensation presents a conflict of interest and should be taken into account when evaluating our communications. Price ranges, targets, and performance estimates referenced are typically based on historical low-to-high intraday pricing, are approximate, and are not guaranteed. Any forward-looking statements or projections are speculative and involve known and unknown risks that could cause actual results to differ materially. By accessing our content via email, website, social media, or other distribution channels, you acknowledge and agree to our full terms of use and disclaimer, which can be found on our website. Never base any investment decision solely on the information provided in our publications. By viewing our emails, website, or social media posts, you are agreeing to our full disclosure found here.