- Weekdays 9:30 AM - 4:00 PM EST

- Fort Lauderdale, USA

Best Penny Stocks In 2023

admin

Best Penny Stocks In 2023

Penny stocks, as the name suggests, cost a few pennies. However, you should not be tempted by these low-cost or cheap stocks. The reason can be many, like the company is in its initial stage of business or has not been doing well lately, or has suffered a major setback in business operations. However, the companies that capitalize on their situations come out stronger, reflected in their stock prices which tend to increase over time. Hence, finding the best penny stocks takes a bit of sincere effort to study the company’s business environment and the edge it possesses to grow in the future.

Let’s see some of the best penny stocks that have the potential to grow, provided they seize the opportunities that come their way.

June 15, 2023

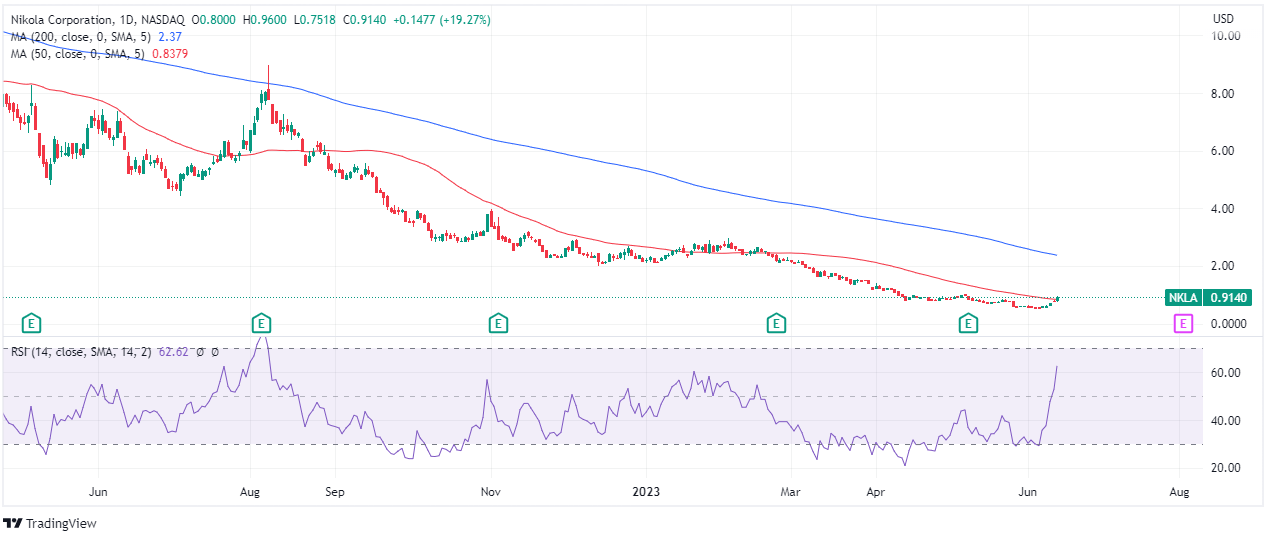

Nikola Corporation (NKLA)

The Nasdaq-listed company is engaged in the manufacturing of fuel-cell semi-trucks, electric vehicles, and energy storage solutions. The revenue increased five-fold in the first quarter, worth $11.1 million from $1.9 million YoY. The company plans to shift focus from capital-intensive segments to hydrogen-fueled cell trucks, vehicle controls, and autonomous technologies to gain first mover and competitive advantage.

Underlying Fundamentals and Technicals

- The current ratio (mrq) is good enough at 1.2, indicating the current assets are sufficiently available to meet the short-term debts.

- The price/book ratio (mrq) at 1.2 suggests the market price is trading near the stock’s book value.

- The stock price is trading at $0.9140, just marginally ahead of its 50 DMA at $0.8379. The price has gained over 45% in the current month till the closing of the June 13 trading session.

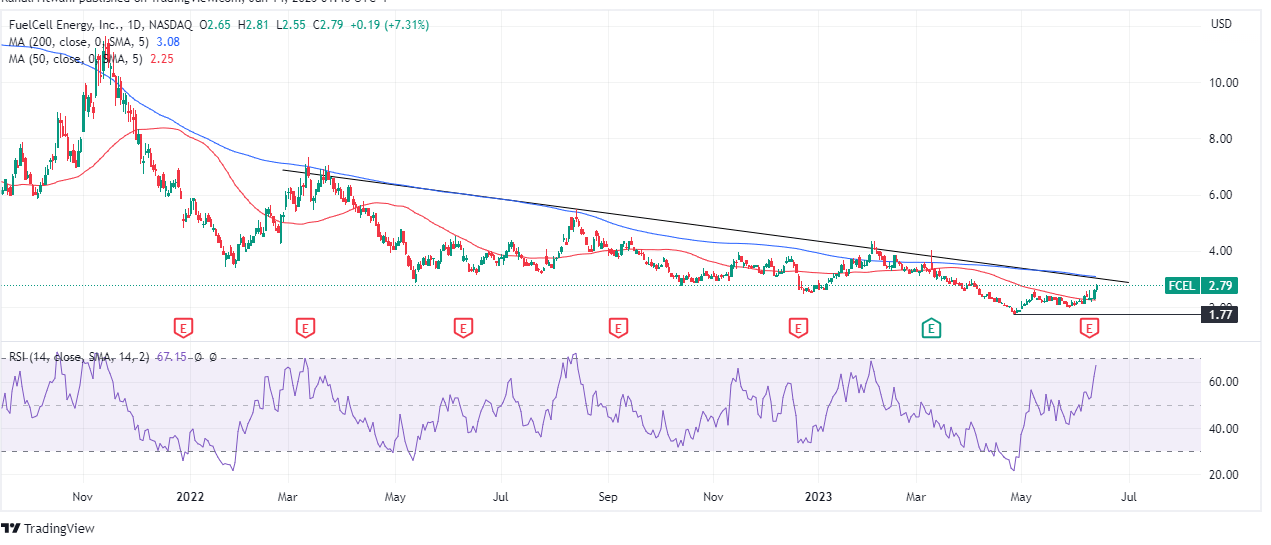

FuelCell Energy, Inc

The Nasdaq-listed company reported a 133.8% increase in revenue in the second quarter with $38.3 million, beating the consensus estimates by 25%. The completion of its two underway projects in Connecticut and the Long Beach Toyota project can drive the company’s revenue.

Fundamental and Technical Aspects

- As derived from Yahoo‘s stats, the price/sales ratio at 7.10 can be attributed to the growing revenue increase, with investors expecting the performance to continue in the future.

- The price/ book financial ratio stands at 1.78, with the book value per share (mrq) at 1.69.

- The stock created a recent low of $1.77 in April 2023 and has gained above 55% since then.

- The price has comfortably managed to sustain above its 50 DMA, which stands at 2.25 with a daily RSI of 67, indicating bullish momentum in the stock.

- If the stock crosses the 200 DMA, presently at 3.08, it would further help the buyers continue the uptrend.

FAQs

The company’s underlying fundamentals, such as financial health and strong business prospects, should be considered before investing in the best penny stocks.

The best penny stocks can be identified by analyzing the financial strength of the companies through various financial metrics such as price/sales ratio, current ratio, debt/equity ratio, and others.

Yes, they can provide outsized gains, provided they experience revenue growth, which contributes to making their financials strong and healthy.

Some penny stocks are traded on recognized stock exchanges like Nasdaq, while others are traded in the OTC markets.

Yes, it can happen when the company is forced to close its operations due to large losses. In such a scenario, the investment amount can reduce to a negligible amount, making it worthless. Hence, proper due diligence should be done before investing in such stocks.